Commercial Flooring Demand Drivers

Featuring in-depth data and insights backed by primary research – now available in PDF, Excel and our interactive portal.

Commercial flooring demand decreased from 8.1 billion square feet valued at $14.8 billion 2022 to 8.0 billion square feet valued at $14.4 billion in 2023, a rate of -0.2% by volume and -2.1% by value.

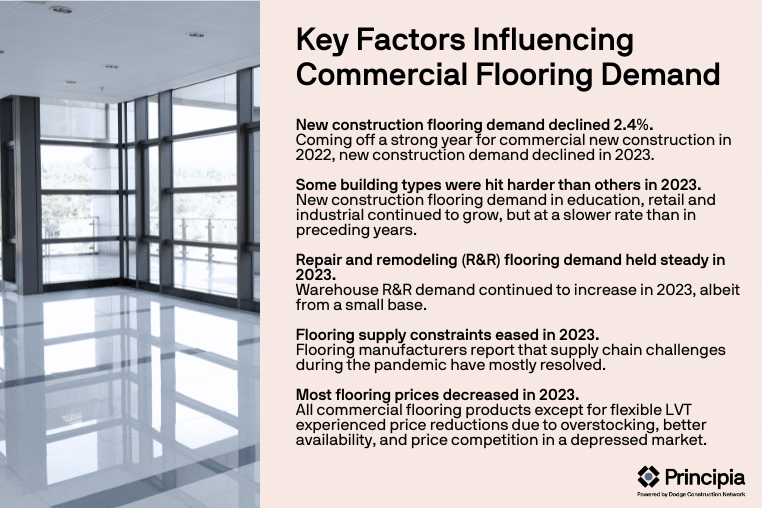

Factors influencing commercial flooring demand include:

New construction flooring demand declined 2.4%. Coming off a strong year for commercial new construction in 2022, new construction demand declined in 2023. The Federal Reserve implemented several interest rate hikes that increased borrowing costs and led builders and property owners to cancel or postpone projects. In addition, property owners had greater difficulty obtaining loans as banks tightened lending standards for commercial projects.

Some building types were hit harder than others in 2023. New construction flooring demand in education, retail and industrial continued to grow, but at a slower rate than in preceding years. Medical, and hospitality flooring demand declined in the mid to high single digits after large increases in 2022.

Repair and remodeling (R&R) flooring demand held steady in 2023. Warehouse R&R demand continued to increase in 2023, albeit from a small base. Medical, education, and hospitality R&R had slight increases in demand following strong growth in previous years, while office, retail and industrial experienced slight declines.

Flooring supply constraints eased in 2023. Flooring manufacturers report that supply chain challenges during the pandemic have mostly resolved. However, the 2021 Uyghur Forced Labor Prevention Act caused some Chinese imports—especially certain types of LVT—to be held by U.S. Customs at port until compliance was verified, causing delivery delays and large additional storage costs which led some importers to cancel and return orders.

Most flooring prices decreased in 2023. All commercial flooring products except for flexible LVT experienced price reductions due to overstocking, better availability, and price competition in a depressed market. Most products had large price increases in 2021 and 2022 due to increases in raw material, transportation, and labor costs as well as product shortages amidst high demand.

New Construction Demand Projected to Grow In 2025 and 2026

The commercial flooring market is expected to see limited growth in 2024 before surging in 2025 and 2026 as property owners respond to declining inflation and lower interest rates. New construction demand growth will outpace R&R, but because R&R accounts for over 90% of market volume, the R&R market will generate most of the new demand.

Hospitality to Lead Growth by Building Type

Hospitality is anticipated to lead the market with nearly 3% annual growth through 2026, with particularly strong growth in new construction volume and above market growth in R&R. After a sharp decline in 2020 and modest growth in 2021, property owners are investing in hospitality again as Americans resume normal travel post-pandemic.

Learn more about DemandBuilder® Commercial Flooring today. For a full demo of our interactive portal or to inquire about the cost to purchase data please email sales@principiaconsulting.com.