What Is Driving Residential Flooring Demand?

Featuring in-depth data and insights backed by primary research – now available in PDF, Excel and our interactive portal.

Residential flooring demand decreased from 16.7 billion square feet valued at $25.5 billion in 2022 to 16.2 billion square feet valued at $23.5 billion in 2023.

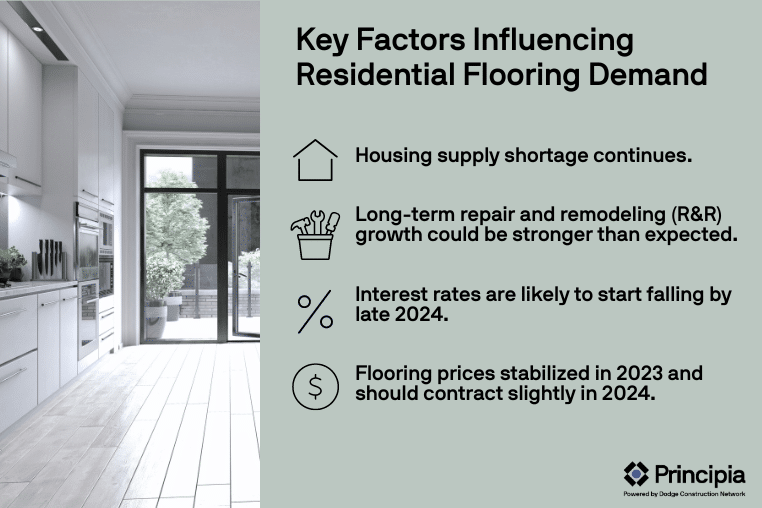

Factors influencing residential flooring demand include:

Housing supply shortage continues. Industry estimates place the housing shortage somewhere between one to three million homes. This underbuilt nature of the market continues to provide a layer of supply side security and buffer against the prospect of a prolonged or subsequent corrections in new home construction. Single family starts began to pick up in early 2024.

Interest rates are likely to start falling by late 2024. If enough progress has been made toward inflation targets, the Fed is expected to start reducing rates in the latter part of 2024, which should encourage home construction, turnover and R&R activity.

Long-term repair and remodeling (R&R) growth could be stronger than expected. The outlook for R&R spending over the coming decade is supported by aging homes built during the early 2000s building boom. According to the U.S. Census Bureau, the average U.S. home is 40 years old and increasing. A large percentage of homes are now entering prime remodeling age, having an age of 20-39 years. Americans are staying in their homes longer and owner equity in U.S. residential real estate is at a record level, further supporting home improvement investment.

Flooring prices stabilized in 2023 and should contract slightly in 2024. The industry should benefit from price stabilization, which will support demand growth in R&R as property owners move forward with postponed R&R projects. This benefit should continue through 2024 as inflation moderates.

Sunbelt Regions Projected to See Strongest Growth

The Southeast, Southwest, and West regions hold more than two-thirds of residential flooring demand in 2023, and together are projected to grow an average of 4% through 2026. Growth by volume will be driven primarily by strong new construction demand in these regions.

Laminate to Lead Product Demand

While luxury vinyl tile (LVT) will have the most share by square footage, laminate will have a CAGR of over 6% through 2026, driven by improved product performance and a lower price point appealing to budget-conscious builders and remodelers. Product enhancements and continued innovation will continue to influence product share trends through the forecast.

Learn more about DemandBuilder® Residential Flooring today. For a full demo of our interactive portal or to inquire about the cost to purchase data please email sales@principiaconsulting.com.