Lumberyard Sentiment: Tracking Three Measures Quarter-Over-Quarter

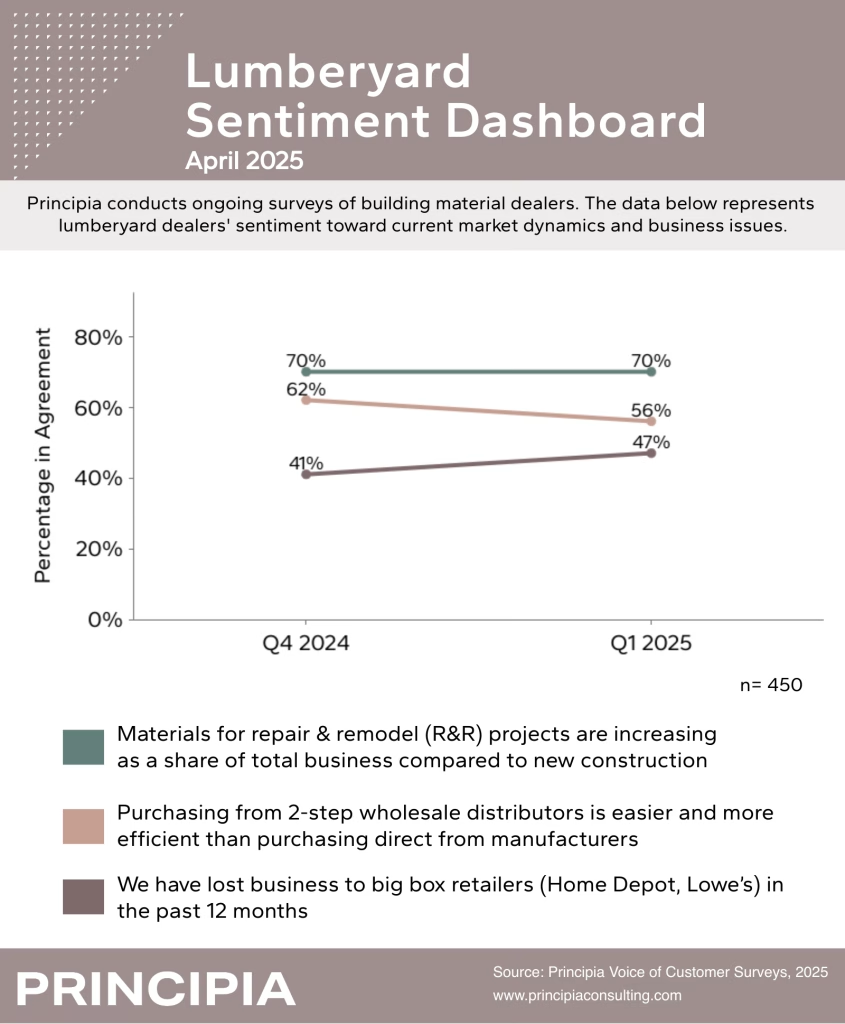

Principia’s latest lumberyard sentiment dashboard looks at three measures, R&R demand, purchasing preferences and big box competition and compares results from Q4 2024 to Q1 2025.

Share of sales for repair and remodeling projects are increasing compared to new construction.

Though this sentiment has remained constant quarter-over-quarter, a large majority of lumberyards state R&R spending, as a share of their total business, is increasing.

Is buying direct from manufacturers becoming easier for lumberyards?

Perhaps it is too early to claim a trend, but fewer lumberyards reported purchasing from two-step wholesale distributors as easier and more efficient than purchasing directly from manufacturers. This sentiment seems to be in line with lumberyards’ indication they are purchasing more direct than in the past and their preferences towards the better payment terms provided by the manufacturer.

Big box retailers pose a competitive challenge to lumberyards.

Quarter-over-quarter, there was an uptick in how lumberyards feel towards big box retailers and if they are presenting a greater threat to their business. Again, perhaps too early to call it a trend, but we will continue to monitor lumberyard sentiment towards big box competition.

Follow Principia’s Voice of Customer content for the latest insights from one-step dealers, lumberyards, builders, and contractors.