Tracking Purchase Trends with One-Step Dealers

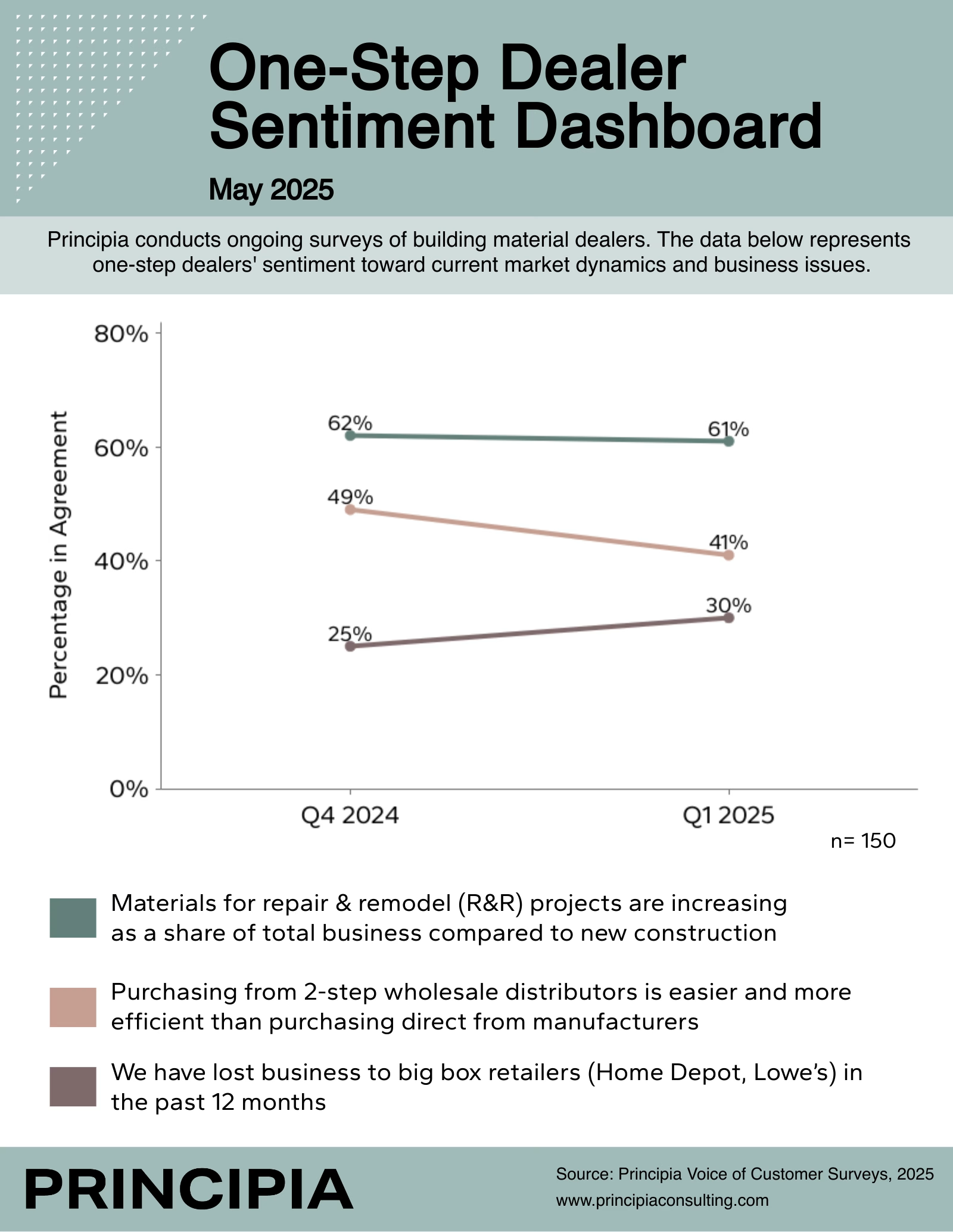

Principia’s one-step sentiment series tracks the perceptions of one-step distributors on key business issues over time. Below are the results of three measures from Q4 2024 to Q1 2025. The same measures for lumberyards were evaluated recently and can be found here.

Share of sales for repair and remodeling projects are increasing compared to new construction.

This sentiment has remained the most constant over the tracking period. Over 60% of one-step distributors agree R&R spending, as a share of their total business, is increasing. This corresponds to the findings of our lumberyard respondents.

Buying direct from the manufacturer appears to becoming easier for one-step distributors.

Research results indicate an increasing percentage of one-steppers are purchasing through distribution (as opposed to direct). While too early to declare a trend, fewer one-steppers state it is easier and more efficient to purchase from two-step distributors than purchasing directly. Principia will continue to track this sentiment over time.

Big box retailers have had a minimal impact on one-step distributors.

Over the tracking period, one-step distributors feel big box retailers represent less of a threat than their lumberyard counterparts. We will continue to monitor one-step sentiment of big box competition, but data from Q4 2024 to Q1 2025 suggests increasing encroachment from big box.