How H.R. 1 (“One Big Beautiful Bill Act”) May Impact Housing and Construction

Overview

H.R. 1 of the 119th Congress, referred to by supporters as the “One Big Beautiful Bill Act,” proposes a broad set of tax and economic reforms. Several of its provisions have implications for housing development, construction incentives, and energy-related tax policy. Here’s a breakdown of what’s included the bill and what it could mean for building product manufacturers, builders, and homeowners.

Provision Details

1. Low-Income Housing Tax Credit (LIHTC)

One of the bill’s features is the expansion of the Low-Income Housing Tax Credit (LIHTC), the main federal program used to build and preserve affordable rental housing.

- Increases LIHTC allocation by 12.5% through 2029

- Reduces the bond financing threshold from 50% to 25% (2026–2030)

- Offers a 30% basis boost for rural and tribal area projects

According to the National Housing Conference, these changes could result in the creation or preservation of 527,000 to over 1 million affordable units by 2035.

“This bill represents one of the biggest opportunities in decades to scale up affordable housing nationwide.” -National Housing Conference, 2025

2. Opportunity Zones (OZs)

The bill extends the Opportunity Zones (OZ) program, originally launched in 2017, to encourage long-term investment in economically distressed areas.

- Extends the program through 2028

- Permits new designations through 2033, with at least 33% required to be rural

“Longer-term certainty and rural targeting will help more capital reach underserved housing markets.” -Economic Innovation Group, 2025

3. Accessory and Modular Housing Support

- The bill amends the National Housing Act to support more types of housing, including:

- ADUs (e.g., backyard cottages, garage conversions)

- Manufactured housing loans for both single- and multi-section units

- FHA Title I home improvement loans with increased limits

- New loan caps could supercharge the small-scale housing movement and empower homeowners to create more livable space without moving:

- ~$150,000 for remodeling single-family homes

- ~$195,000 for multi-section manufactured homes (including land)

- Indexed to inflation

“These changes modernize outdated rules and recognize growing demand for flexible, smaller-scale housing solutions.” -Urban Institute, 2025

4. Full Expensing for Capital Investment

This provision lowers the cost of capital investment for everyone from large developers to small modular home manufacturers and is in effect through 2030.

- Reinstates 100% bonus depreciation through 2030

- Eligible for: construction equipment, modular components, factory upgrades

“It’s a game-changer for high-volume ADU builders, prefab startups, and rural home developers.” -National Association of Home Builders (NAHB), 2025

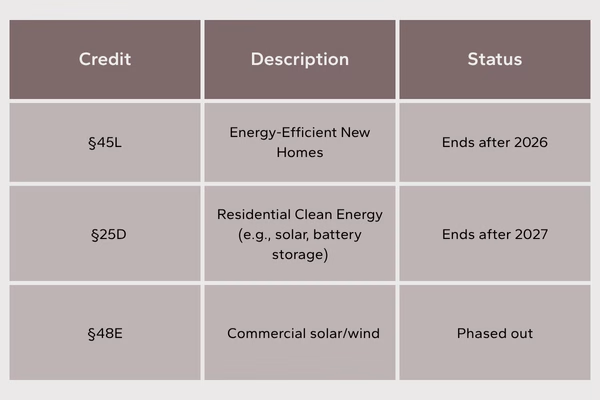

5. Energy-Related Tax Credits

Several credits will be reduced or eliminated as early as within the next two years:

“State-level incentives may continue to drive demand for low-carbon construction materials even as federal policy shifts.” -U.S. Green Building Council, 2025

6. Homeowner Tax Relief

- Raises the SALT (State and Local Tax) deduction cap from $10,000 to $40,000 for households earning under $500,000

- Makes mortgage interest and insurance premium deductions permanent

This restores key tax benefits for residents of states like California, New York, and Illinois, potentially stabilizing markets where affordability has been under pressure.

“Restoring the full SALT deduction helps stabilize high-cost housing markets and gives certainty to homeowners.” -Tax Foundation, 2025

Strategic Considerations for Building Product Manufacturers

A few considerations for building product manufacturers as the industry begins to navigate the changes:

1. Consider Engaging with Affordable Housing Demand

- Track LIHTC-funded developments

- Evaluate the opportunity to emphasize qualifying products such as insulation, modular kitchen/ bath systems, windows, etc.

2. Plan Around Tax Credit Phase-Outs

- Consider promoting §25C/§25D-eligible energy-efficient materials while credits remain active (through 2025–2027)

- Assess collaborating with developers on timing and product offerings to take advantage of tax credits prior to expiration

3. Adapt to Evolving Market Shifts

- Weigh shifting messaging from tax benefits to performance metrics (e.g., cost savings, durability, energy use)

- Consider preparing product lines for states that may pursue independent green building codes

Conclusion

H.R. 1 introduces several measures aimed at expanding housing development and lowering barriers to capital investment, especially in rural and affordable segments. At the same time, it scales back federal incentives for residential and commercial clean energy deployment. The net impact on the housing and construction industries will depend on how state policies, market conditions, and investor responses will evolve.

* Any content provided in this blog is for informational purposes only and should not be interpreted as representing the views of Principia and Dodge Construction Network. You can also check out a recent summary on the topic from Eric Gaus, Chief Economist at Dodge Construction Network.

Sources: