How Homeowners Are Funding Repair and Remodeling Projects

The way homeowners finance their repair and remodeling projects is shifting. New data reveals a growing trend towards less cash funding and more home equity lines of credit.

Principia has been tracking these shifts over the past year by posing the following question to specialty contractors and remodelers.

What percentage of your projects were funded through the following?

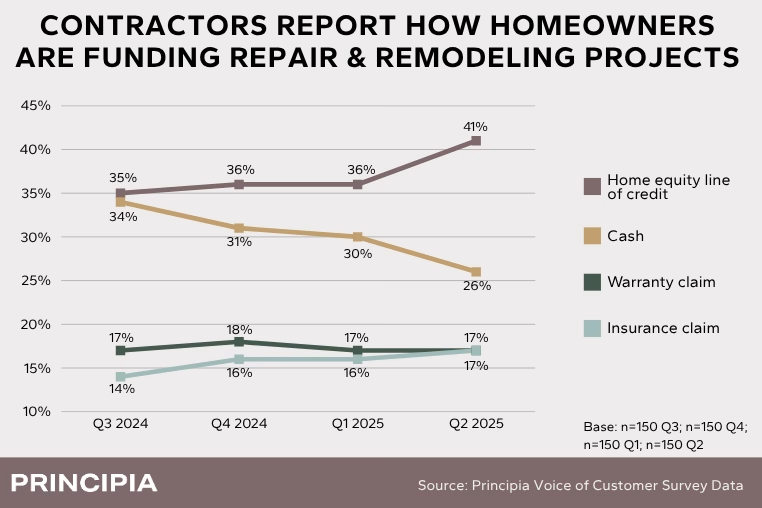

Over the last twelve months, contractors and remodelers indicate their repair and remodeling projects are predominantly funded through cash or home equity lines of credit (HELOC). As you might expect, insurance and warranty claims maintain smaller, albeit more consistent shares.

Perhaps the most interesting takeaway is the growth of HELOC for financing R&R projects and the decline of cash funded projects. As cash funding declines, home equity lines of credit have emerged as the preferred alternative for many homeowners.

HELOC rates have generally decreased over the past year, with some lenders reporting rates falling to two-year lows. While rates spiked in September 2024, they have since dropped, making HELOCs more attractive for accessing home equity.

In addition to the growth of HELOC for financing R&R projects, our DemandBuilder® models anticipate an approximate 2% growth rate year-over-year in R&R spending.