Building Material Dealers: Assessing the Frequency and Impact of Follow-up and Rush Orders

Lumber and building material (LBM) dealers regularly wrestle with various factors impacting operations and profitability. For this article, we will be examining results from Principia’s ongoing, monthly surveys of Lumberyards and Traditional One-Step Distributors (fielded from June 2024 to June 2025) to gain a better understanding of the following:

- Extent to which pro customers need to make additional orders with their dealers to meet initial order shortfalls on their projects

- Frequency by which these additional orders are categorized as “rush orders”

The results are interesting and pose a potential negative impact on dealers’ and suppliers’ bottom line. How common is this problem, and what can be done to mitigate it?

Additional Orders

Nearly all LBM dealers place additional orders for their builder and contractor customers due to product shortfalls on their projects. We sought to determine the frequency by which this scenario occurs by asking the following question:

How often do customers place additional orders for materials on top of their original order (due to product shortfalls, inaccurate estimating, etc.) on a project?

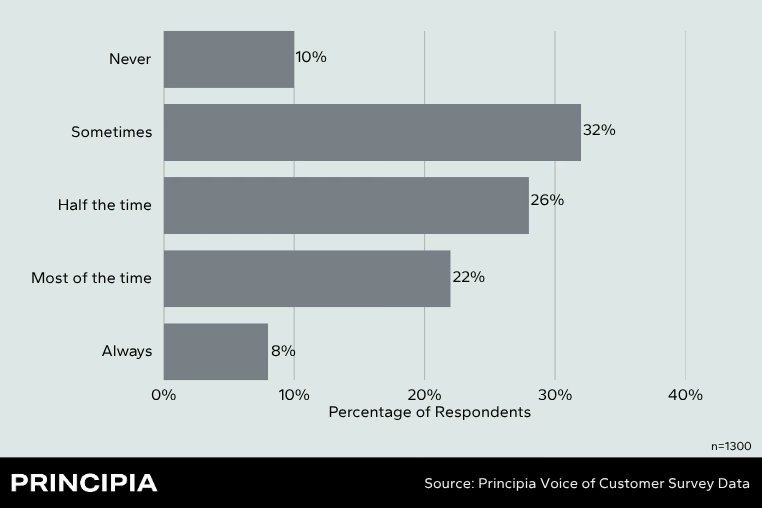

Figure 1: LBM Dealers Reported Additional Material Orders Due to Ordering Shortfalls

As Figure 1 illustrates, when pro customers purchase materials from their dealer, more than a third (40%) return for additional product orders either always (7%) or frequently (33%). Additionally, nearly two-thirds (64%) of customers return for additional product half the time or more.

Reinforcing these findings, respondents from our ongoing, monthly survey of Builders and Contractors largely resemble the dealer findings, as shown in Figure 2:

How often does your company place additional orders for materials, on top of your original order, due to inaccurate estimation, product shortfalls or waste, etc.?

Figure 2: Builders and Contractors Reported Frequency of Additional Material Orders

Once again, a majority of builders and contractors (58%) report the need to place additional material orders at least half the time or more.

The reasons for consistent product shortfalls on original orders can be debated. Potential reasons could include:

- Construction pros (or their dealer partners) using “best case” scenarios when estimating the amount of product needed for a job

- Underestimating typical breakage, product defects, miscuts, or other construction waste for the job

- Estimation software producing poor calculations

- Difficulty and/ or reluctance of their LBM dealers to accept returns of unused product, which motivates purchasing too little over too much

Whatever the reason, a sizeable majority of construction professionals have become accustomed to under-purchasing what’s needed for a job, necessitating additional purchases. Two transactions certainly cost more than one – in expense and labor – for an LBM dealer to process.

Rush Orders

Consistently making additional orders isn’t the only issue resulting in less than peak efficiency for an LBM dealer. To further explore the issue, we asked a follow-up question:

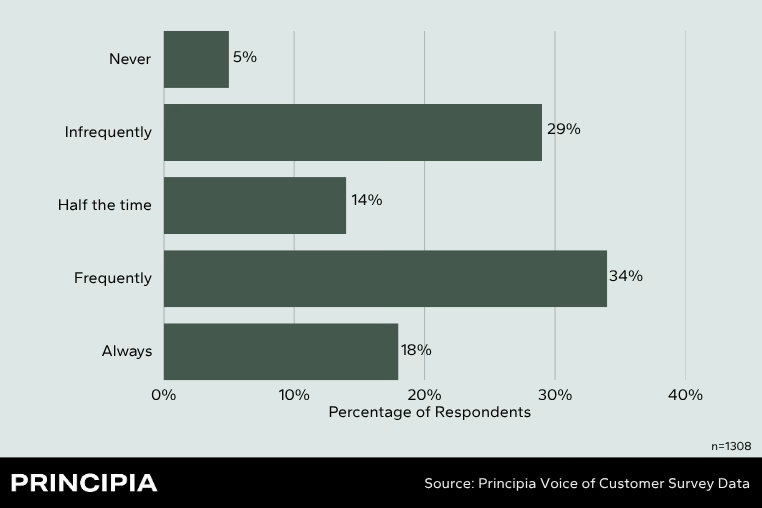

How often are those additional materials typically rush ordered?

Figure 3: LBM Dealers Report Frequency of Additional Materials Rush Ordered

As Figure 3 represents, more than half of the dealers surveyed (52%) report the additional orders as “rush ordered” either frequently or always. Moreover, almost two-thirds of dealers (66%) state these additional orders are “rush ordered” half the time or more.

The rush orders can result in additional strain on the dealers, two-step distributors, and product suppliers who process them.

Opportunity for Change?

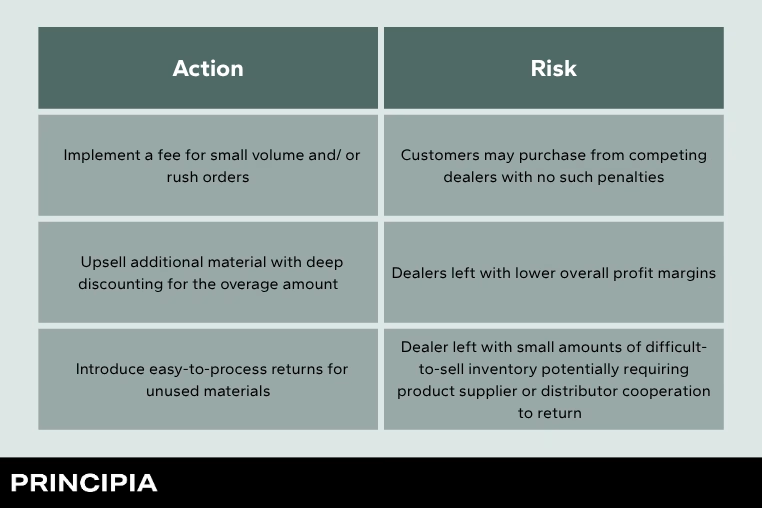

There may be an opportunity to change purchasing behavior to help alleviate the number of rush orders and the additional strain they can put on the dealer or product suppliers.

If you’re reading this as a member of our dealer or product supplier community, and you see these statistics as a real business problem to solve, what can your organization do to change this behavior? It requires action or no change will occur.

Listed below are three potential actions dealers might take. Each comes with risks, so we’ll highlight those too.

Conclusion

Dealer customers frequently place additional orders, often rush-ordered, due to product shortfalls. This places undue pressure on building material dealers and product suppliers to fulfill, affecting operations and profitability.

Ultimately, the statistics presented here definitively show that dealer customers have a clear preference for ordering too little product over ordering too much. In other words, they’re comfortable with the current purchasing process regardless of its impact on the supply chain.

To change their behavior, incentives and benefits for ordering enough product on initial purchase must outweigh the penalties of ordering too little. Without these two components, purchasing behavior is unlikely to change.

If managed correctly, addressing the issue of frequent additional and/ or rush ordering can lead to more efficient operations, reduced costs, and higher dealer profitability.

Stay ahead of industry challenges by partnering with Principia, who can provide comprehensive market insights and strategic solutions. Contact us today to learn how we assist businesses in navigating market obstacles to achieve success.