Navigating the Fiberglass Shortage: How the Industry Adapted

The fiberglass insulation market has been under pressure in recent years due to:

- Supply chain disruptions

- A surge in single-family new construction (especially in 2024) to alleviate the housing shortage across the U.S.

- Stricter residential and commercial energy codes

Fiberglass capacity starts to tighten when housing starts hit 1.4–1.5 million annually. Because it’s used more heavily in residential projects, commercial jobs may be deprioritized when residential demand spikes. More fiberglass capacity came online in 2024 and more is expected in the coming years, but until then, the insulation industry will have to continue to adapt when new construction is strong.

Principia recently conducted a survey of 150 commercial insulation contractors. The findings provide a ground-level view of current market dynamics and offer a valuable lens into the impact of fiberglass shortages.

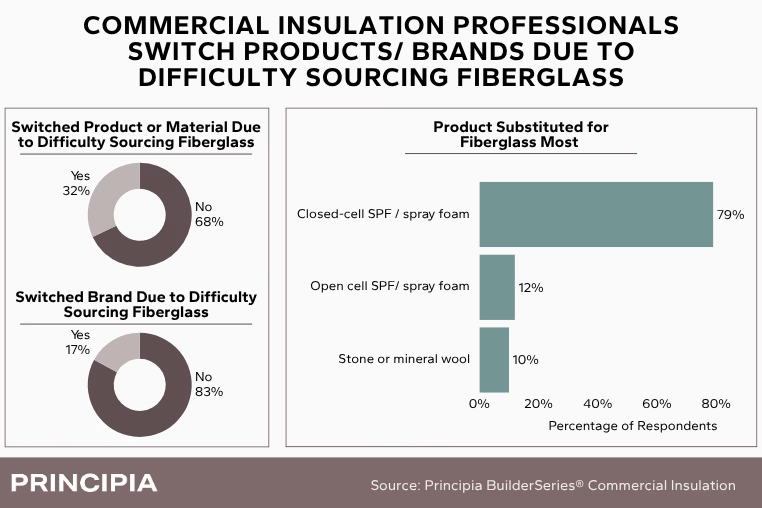

1 in 3 Commercial Insulation Professionals Have Switched Products Due to Fiberglass Shortages

According to the data, 32% of respondents have switched to a different product or material altogether due to difficulty sourcing fiberglass. This represents a shift in material use due to lack of availability, signaling how serious and widespread the supply issue was in 2024. However, despite these challenges, 68% of respondents managed to stick with fiberglass, highlighting that for many, the product’s value and performance still outweigh the hurdles in procurement.

Brand Loyalty Remains Strong, But Not Absolute

When it comes to switching brands within the fiberglass category, the change is less dramatic. Only 17% of respondents said they have switched brands due to supply issues. This suggests a relatively strong brand loyalty, or perhaps limited viable alternatives, even when sourcing becomes problematic. A majority are continuing to rely on the same brand, possibly due to trust in product performance, familiarity, or contractual relationships.

Closed Cell Spray Foam: The Most Popular Substitute

When fiberglass isn’t available, what are professionals turning to? The data shows a clear preference for closed-cell spray foam insulation, with 79% of respondents indicating it as their go-to substitute. This option offers strong insulating properties and durability, making it an attractive, albeit more expensive, alternative. Closed cell SPF can also be an air barrier to help with the problem of thermal bridging, which has become increasingly more relevant in recent years. Meanwhile, open-cell spray foam was chosen by 12%, and stone wool accounted for just 10% of responses.

Takeaways: Planning for Flexibility

The takeaway from this data is clear: while fiberglass remains a staple in the insulation world, ongoing supply challenges have pushed a significant number of professionals to explore alternatives in recent years.

For suppliers, this is a critical signal to improve supply chain resilience and emphasizes that the recent capacity announcements coming from the fiberglass market are warranted.

For contractors and builders, the message is to stay flexible, maintain strong supplier relationships, and be open to product education in case substitutions are necessary. As the construction industry continues to adapt to evolving market pressures, the ability to pivot without compromising on quality will remain a key competitive advantage.