Mixed Signals in Residential Construction: What Dealers, Builders, and Contractors Are Telling Us

As the residential construction market continues to navigate economic uncertainty, we’ve been tracking sentiment across key players—lumberyards, one-stepper dealers, homebuilders, and contractors—through quarterly surveys. These groups are on the front lines of housing development, and their perspectives offer valuable insight for manufacturers, distributors, and investors looking to understand where the market might be headed.

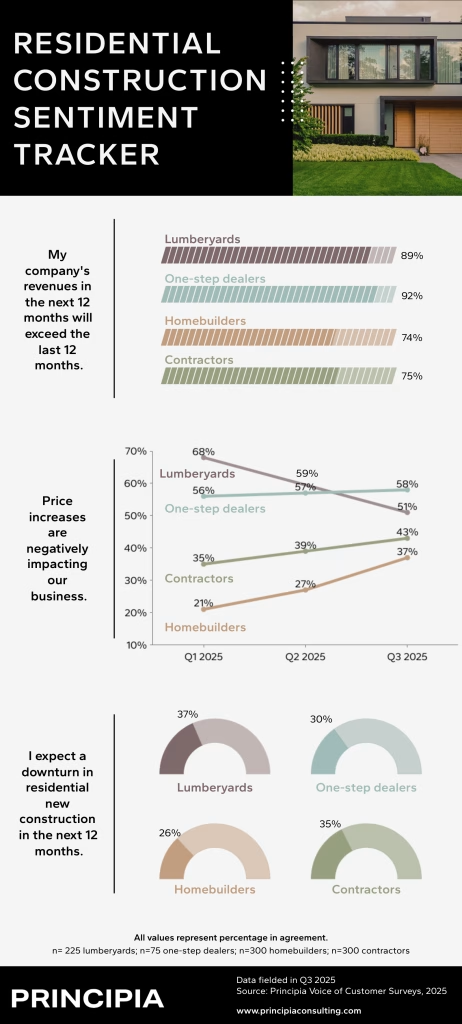

We ask three core questions each quarter:

- Will your company’s revenue in the next 12 months exceed the last 12 months?

- Are price increases negatively impacting your business?

- Do you expect a downturn in residential new construction in the next 12 months?

The latest results reveal a market that’s neither bullish nor bearish—but rather, cautiously watching the horizon.

Revenue Expectations: Optimism Holds, But Builders Pull Back

Most dealers and contractors remain optimistic about their revenue outlook. Their sentiment suggests confidence in demand and operational resilience. However, homebuilders are showing signs of concern. Their confidence in achieving higher revenue dropped by 7% compared to Q1—a notable shift that may reflect tightening margins, slower permitting, or hesitancy in consumer demand.

Pricing Pressures: Builders and Contractors Feel the Squeeze

Price increases continue to be a thorn in the side of many respondents—but the impact varies by group:

- Lumberyards have seen a significant drop in concern about pricing since Q1, suggesting some relief or better cost management

- Dealers are holding steady with a neutral view, possibly buffered by diversified product lines or improved supply chain conditions

- Builders and contractors, however, are increasingly feeling the pinch. Their sentiment around pricing’s negative impact has grown quarter-over-quarter, pointing to tighter budgets and more competitive bidding environments

New Construction Outlook: A Growing Sense of Caution

When asked whether they expect a downturn in residential new construction over the next 12 months, responses across the board leaned more negative in Q3 compared to Q1. On average, there was a 7% increase in anticipating a slowdown by lumberyards, one-steppers and homebuilders. Contractors, however, remain relatively neutral—perhaps due to their diversified project mix between new construction and repair and remodel or backlog stability. This creeping pessimism could be signaling broader concerns about interest rates, affordability, and inventory saturation.

At Principia, we remain committed to delivering actionable voice of customer insights that provide businesses with the knowledge to better navigate challenges and capitalize on opportunities.