Residential Construction Sentiment Tracker: A Year in Review

For the past year, our research team has fielded ongoing surveys among key players in residential construction—lumberyards, one‑step distributors, homebuilders, and contractors. These recurring insights help us understand how confidence, challenges, and expectations shift across the market.

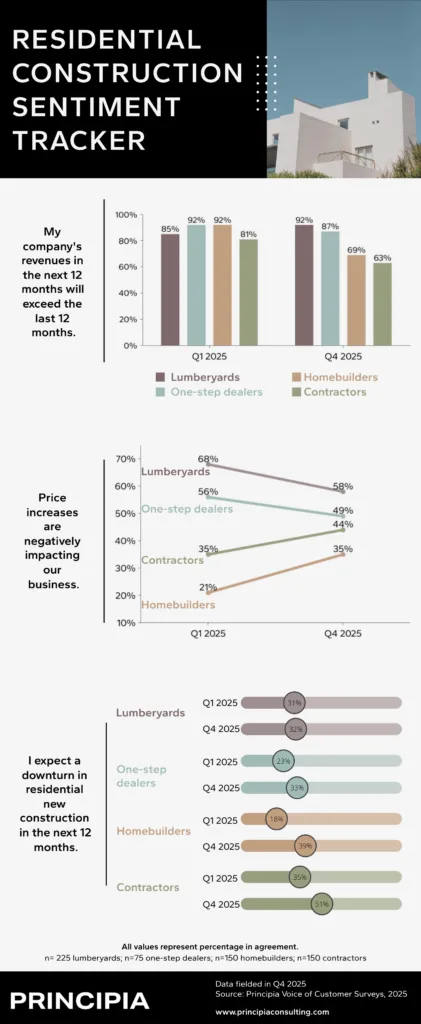

Our analysis centers on three core indicators:

- Revenue Expectations – Confidence in surpassing revenue from the previous 12 months.

- Impact of Price Increases – How rising product costs are affecting business performance.

- Market Outlook – Expectations for a potential downturn in new residential construction within the next year.

With a full year of results now in hand, we reviewed how sentiment evolved as the industry navigated 2025’s economic uncertainty.

Homebuilders and Contractors Are Notably Less Confident in Revenue Growth

Homebuilder and contractor optimism around revenue potential declined sharply throughout 2025.

- Homebuilders: 92% expected higher revenue in Q1, dropping to 69% by Q4.

- Contractors: Declined from 81% in Q1 to 63% in Q4.

This softening outlook may reflect tightening margins, slowing permit activity, or shifting consumer behavior as affordability pressures persist.

By contrast, lumberyards and traditional one‑step distributors remained steadily optimistic—and even grew more confident over the year.

- Lumberyards: Increased from 85% agreement in Q1 to 92% in Q4.

Their continued confidence suggests stability in professional demand, backlog strength, and effective cost management strategies.

Stakeholders Hold Mixed Views on the Impact of Price Increases

Sentiment diverged sharply between distributors and builders when assessing the business impact of rising prices.

- Lumberyards and one‑step distributors showed a slight decline in negative sentiment by Q4, though concerns remain:

- 58% of lumberyards and 49% of distributors still reported price increases negatively affecting their business.

- Homebuilders and contractors moved in the opposite direction, with concern levels rising an average of 11.5% from Q1 to Q4.

For builders and contractors, rising costs may be amplified by higher labor expenses, stricter bidding environments, increased financing costs, and overall tighter budgets—intensifying pressure on project profitability.

Rising Expectations of a Downturn in New Residential Construction

Across most audiences, expectations of a downturn in new construction grew materially in 2025.

Between Q1 and Q4:

- One‑step distributors: Increased from 23% to 33% expecting a downturn.

- Homebuilders: Jumped sharply from 18% to 39%.

- Contractors: Increased from 35% to 51%.

- Lumberyards: Sentiment remained stable, showing no notable change across the year.

This growing pessimism—particularly among builders and contractors—likely reflects ongoing concerns over mortgage rates, affordability constraints, and slowing new project starts.

Lumberyards’ stable sentiment may indicate that while builders foresee fewer new starts, distributors still anticipate steady repair‑and‑remodel demand or lagging indicators tied to existing project pipelines.

What This Means for Building Product Manufacturers

As sentiment becomes more polarized across the channel, manufacturers should consider possible reactions in the market:

- More cautious ordering behavior among builders and contractors.

- Pressure on pricing justification, particularly where costs remain elevated.

- Greater interest in value‑added services like logistics support, training, and product differentiation to defend margins.

- Demand stability in distribution, where optimism remains comparatively strong.

Understanding these shifts can guide strategic adjustments in sales planning, pricing strategy, inventory positioning, and messaging for 2026.