Average Cost of Commercial HVAC Systems: Insights for Manufacturers

Understanding the average cost of commercial HVAC systems across building types is essential for manufacturers seeking to assess market opportunity, refine product positioning, and guide strategic planning.

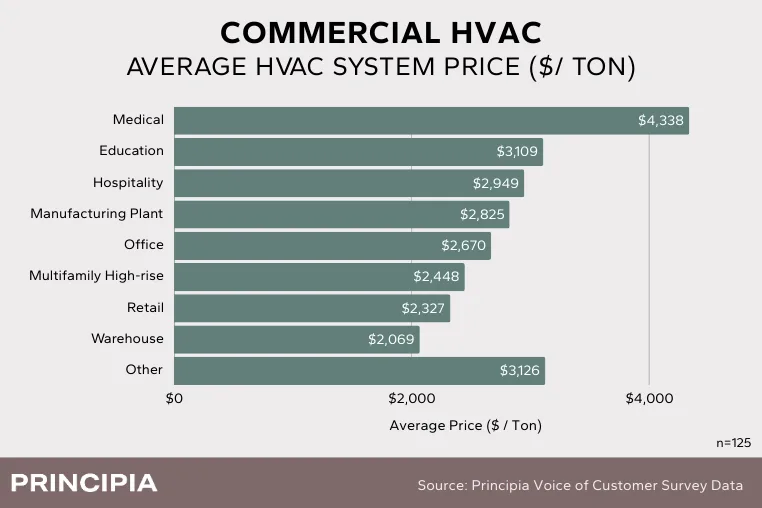

Recent survey data from a national sample of 125 Mechanical Contractors, Commercial HVAC Technicians, and Mechanical/HVAC Engineers provides a detailed view of pricing trends across the commercial HVAC landscape.

Respondents were asked to report the average installed HVAC system price ($/ton) for the commercial building projects they completed. A total of 484 building systems were profiled, representing a broad cross‑section of project types and system configurations.

Key Findings: Variability in HVAC Costs by Building Type

Commercial HVAC system costs vary significantly depending on building size, design requirements, and system complexity. Several clear trends emerged:

- Higher Complexity = Higher Cost

Buildings that require more sophisticated air handling, filtration, zoning, or redundancy tend to show higher cost per ton. Medical facilities and educational buildings fall into this category due to strict ventilation requirements, higher occupancy levels, and energy standards. - Standardized, Lower‑Complexity Buildings Show Lower Costs

On the opposite end, retail spaces and warehouses typically require simpler mechanical systems with fewer control layers and less specialized air management, resulting in lower average costs per ton. - Overall Market Benchmark

Across all commercial building types surveyed, the average HVAC system cost is $2,873 per ton.

This provides a useful benchmark for evaluating:- Installation labor dynamics

- Competitive pricing

- Market segmentation opportunities

- Positioning against alternative HVAC technologies

Considerations for HVAC Manufacturers

These pricing dynamics offer several strategic considerations for manufacturers seeking to grow market share and align product portfolios with market demand.

- Identify High‑Value Market Segments.

Higher‑cost segments such as healthcare and education represent opportunities for:- Advanced air quality and filtration solutions

- High‑efficiency or low‑maintenance systems

- Modular or scalable HVAC platforms

- Understand Competitive Pressure in Cost‑Sensitive Segments

Lower‑priced segments like retail and warehouse settings are more cost‑driven and competitive. Success in these areas often depends on:- Optimizing product cost‑to‑performance ratio

- Reducing installation time or complexity

- Enhancing system reliability and maintainability

- Align Product Development with Market Realities

Accurate cost‑per‑ton benchmarks help manufacturers:- Validate the pricing strategy of existing product lines

- Identify gaps in product offerings

- Forecast adoption of high‑efficiency or advanced tech (VRF, ERV, smart controls)

- Adjust go‑to‑market strategies across building types

- Leverage Voice‑of‑Customer to Strengthen Market Position

Direct insight from contractors, engineers, and technicians helps manufacturers:- Understand decision drivers and pain points

- Track shifts in design preferences

- Gauge market readiness for innovation

- Anticipate trends in regulations, energy efficiency, and sustainability

Opportunity for Manufacturers

Manufacturers that tap into detailed market intelligence are better equipped to navigate the evolving commercial HVAC landscape—especially as efficiency standards rise, building needs become more sophisticated, and competitive pressures increase. Understanding average system costs across building types is just one step, but a foundational one, in evaluating market size, competitive positioning, product strategy, and long‑term growth opportunities.