LBM Dealer Sentiment: Shifts in Inventory Turns from Q1 to Q3 2025

Inventory turns are a vital barometer of business health in the lumber and building materials (LBM) industry. They measure how efficiently products move through the supply chain—impacting everything from cash flow and warehousing costs to forecasting and customer satisfaction.

When inventory turns rise, it typically signals stronger demand and tighter alignment between supply and market needs. A decline, on the other hand, may point to overstocking, slower sales, or misaligned purchasing strategies.

Tracking Dealer Sentiment Across 2025

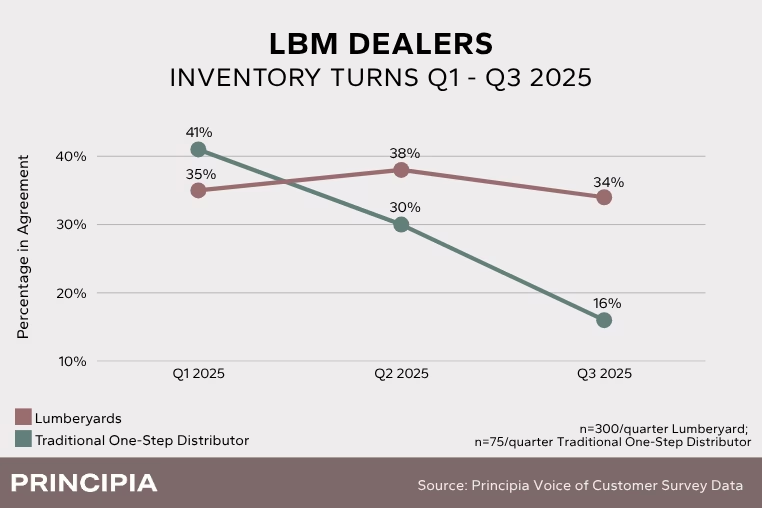

Principia’s ongoing monthly survey has been monitoring how lumberyards and traditional one-step distributors perceive changes in their inventory turns throughout 2025. Respondents were asked to indicate their level of agreement with the statement: inventory turns, on the whole, are decreasing.

The results reveal a notable divergence between the two dealer types:

While lumberyard sentiment has remained relatively stable—hovering in the mid-30% range—traditional one-step distributors have shown a sharp decline in agreement with the statement. From 41% in Q1 to just 16% in Q3, this shift suggests a growing confidence in their inventory efficiency.

What This Could Mean for Building Product Manufacturers

These shifts in dealer sentiment around inventory turns offer manufacturers a window into how their channel partners are managing product flow—and where strategic adjustments may be needed.

Improved Turn Performance Among 1-Steppers

The steep drop in perceived inventory slowdowns among one-step distributors may indicate better demand forecasting, leaner inventory strategies, or stronger downstream sales. Manufacturers should view this as an opportunity to deepen collaboration with these partners, especially around replenishment timing and product mix.

Steady-State at Lumberyards

The relatively flat sentiment among lumberyards suggests a more cautious or consistent approach to inventory. This could reflect regional demand variability, slower-moving SKUs, or tighter working capital constraints. Manufacturers may need to tailor support—such as just-in-time delivery options or promotional programs—to help these dealers optimize turns.

Communication is Key

Understanding how dealers perceive their inventory health can help manufacturers align more closely with their partners’ operational realities. These insights can inform everything from production planning to sales enablement and marketing strategy.