When it comes to purchasing something with a significant cost and shelf life, such as residential siding, homeowners can’t always afford to take a risk. That’s a key reason why most homeowners decide not to replace their existing siding with a different material when making repairs or renovations. As famous American spiritual teacher/ peace activist Peace Pilgrim once said, “almost all fear is fear of the unknown. Therefore, what’s the remedy? To become acquainted with the things you fear.”

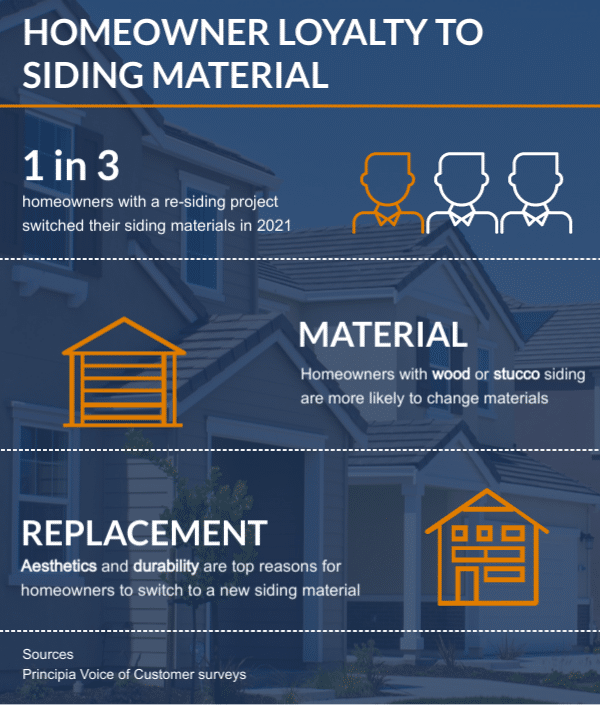

While siding was likely the furthest thing from Pilgrim’s mind when she dropped that bit of wisdom, her words could serve as a rallying cry for siding manufacturers looking to steal share from incumbent materials. And if the last few years are any indication, the opportunity is there. Overall, the siding replacement market was valued at over $5 billion in 2021 at the net manufacturer level, and repair and replacement market growth is expected to outpace new construction through 2024. Last year 36% of homeowners with a re-siding project switched from one siding material to another—compared to 32% the previous year.

Homeowners with stucco and wood siding drove the increase in switching materials. In both cases, the percentages of those switching to another siding material is up 44% and 13%, respectively, over the same duration. Largely, this is because wood has high maintenance requirements and is susceptible to water damage and rot, while stucco can have moisture penetration issues and a tendency to crack/stain and require periodic patching. Additionally, stucco’s rough texture often isn’t as appealing as the smoother wood-look of lap siding.

Homeowners with lower value homes are also contributing to the increase in switching materials as they are more likely to consider new siding solutions as cost-effective ways to improve curb appeal, a key focus in today’s active housing market. Suburban homeowners are more likely to have homes with secondary siding materials and want siding materials amenable to that design trend. Suburban homeowners also exhibit willingness to switch materials to align with updated aesthetics of other homes in their neighborhood.

Manufacturers have an opportunity to target their messaging to homeowners who tend to stay with their incumbent siding material. Emphasizing durability and curb appeal would presumably increase their selling effectiveness. It not only means recognizing that most homeowners are not willing to switch siding materials but crafting new messaging to help broaden new horizons and, as Pilgrim said, “become acquainted with the things you fear.”