Featuring in-depth data and insights backed by primary research – available in PDF, Excel and our interactive portal.

Demand for U.S. residential flooring earned a noticeable uptick behind strong new construction demand and robust repair and remodeling (R&R) activity in 2021. Underlying market conditions have weakened in 2022 but remain favorable for modest growth in the flooring marketing through 2024. Overall year-over-year flooring demand grew from 14.2 billion square feet in 2020 to 15.9 billion square feet in 2021.

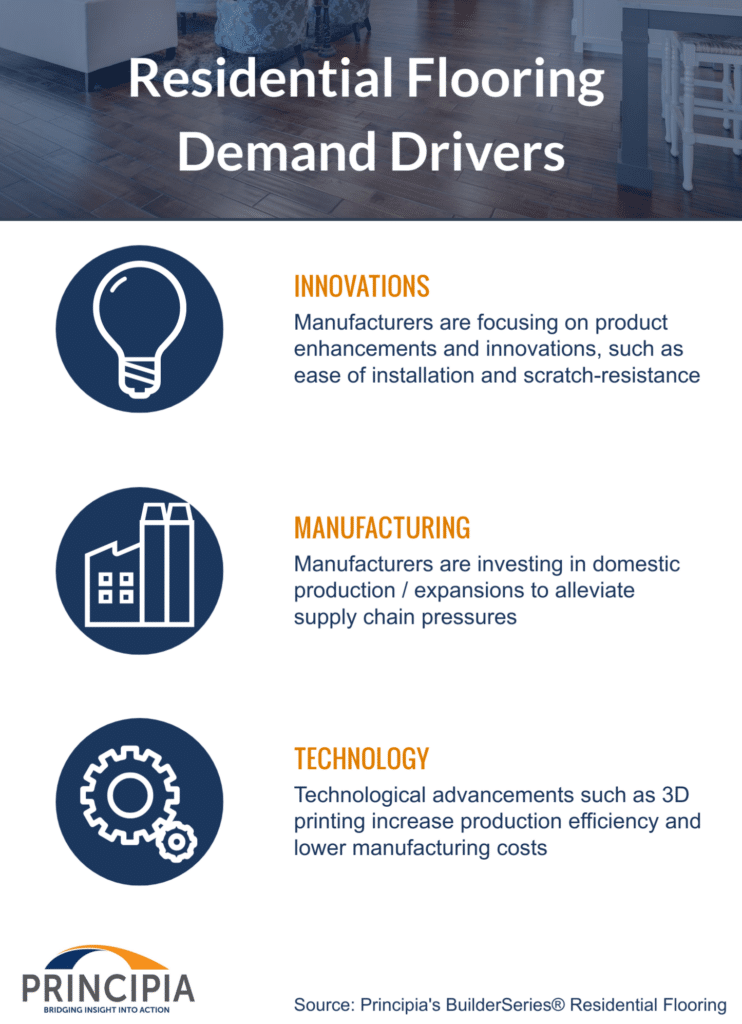

Key factors that will support flooring market demand through 2024 include:

- Product enhancement and innovations such as improved designs, ease of installation, and performance-based attributes like water and scratch-resistance

- Homeowners generally opting for hard surface flooring in the living areas of a home, carpet in bedrooms and upstairs hallways, and more water-resistant products in wet areas such as bathrooms and laundry rooms

- Flooring manufacturers are investing in domestic production/expansions to help alleviate supply chain pressures and remain in closer proximity to product trends

- Technological advancements such as 3D printing continue to gain traction to increase production efficiency and lower costs associated with the manufacturing process

A thriving R&R market pays big dividends for flooring

Residential flooring demand demonstrated strong volume growth of 12% from 2020 to 2021. Most activity occurred in single-family homes (83%). Carpet (42%) earned the plurality of orders, followed by resilient (29%), woods (16%), and naturals (14%).

Residential flooring demand expected to reach 16.6 billion square feet in 2024

Flooring volume will continue to grow over the next three years but nowhere near 2020-21 levels, in large part to a slowdown in new homebuilding. Annual mid-single digit growth in R&R activity, however, will offset some of that deceleration, with lower cyclicality and high home equity and cash balances leading the list of key causes.

An uptick in R&R will help offset diminished new construction starts

While new construction boomed in 2021, it is expected to decline through 2024 with R&R accounting for all incremental demand, net of the contraction in new construction. Flooring is driven by the R&R side of the market and flooring projects are a good way to recoup remodeling costs.

Download the table of contents and list of figures for the written portion of our flooring demand product line up. For a full demo of our interactive portal or to inquire about the cost to purchase data please email Sales@principiaconsulting.com