What Is Driving Residential Windows Demand?

Featuring in-depth data and insights backed by primary research – now available in PDF, Excel and our interactive portal.

United States residential windows demand volume experienced modest growth in 2022, with multifamily new construction and repair and remodeling (R&R) growth helping to offset the decline in single family new construction demand. Demand increased from 63.1 million units valued at $17.4 billion in 2021 to 64.6 million units valued at $20.6 billion in 2022.

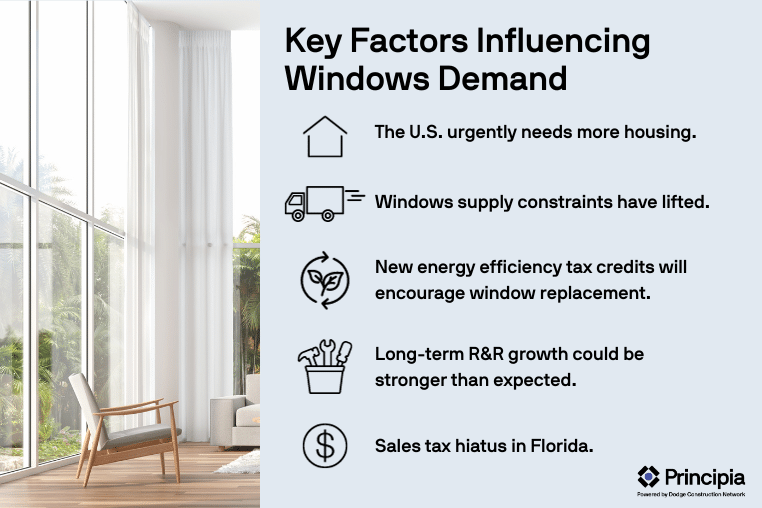

Factors influencing residential windows demand include:

The U.S. urgently needs more housing. Industry estimates place the home building shortage at between 1-3 million homes. This underbuilt nature of the market continues to provide a layer of supply side security and buffer against the prospect of another significant correction in the housing market.

Windows supply constraints have lifted. Window manufacturers report improvements in raw material and transportation shortages. Product availability and lead times have significantly improved, allowing the market to better meet demand.

New energy efficiency tax credits will encourage window replacement. With the federal government’s passing of the Inflation Reduction Act in August 2022, homeowners and home builders can claim new tax credits related to energy efficient home upgrades, including windows and doors.

Long-term R&R growth could be stronger than expected. The outlook for R&R spending over the coming decade is supported by aging homes built during the early 2000s building boom. A large percentage of homes are now entering prime remodeling age of 20-39 years. In addition, homeowners will continue to invest in repair and remodeling projects, influenced by the trend of Americans spending more time at home, record high home equity, and the decision to stay in existing homes with low locked-in mortgage rates.

Sales tax hiatus in Florida. A two-year sales tax hiatus on home-hardening products started in mid-2022 in Florida. This incentive plan should stimulate additional window replacement in one of the nation’s biggest window markets. Florida accounts for about 10% of national windows demand and has the most stringent codes for storm resistant homes.

Repair and Remodeling to Experience Stronger Growth

Repair and remodeling demand is expected to see slightly stronger growth than new construction, given the impact of slower economic growth on new construction in 2023. New construction volume will basically be flat comparing 2022 to 2025. The notable decrease in 2023 is expected to be mostly offset by the strength of recovery in 2024 and 2025, as the economy recovers, and new housing demand resurges. Remodeling spend is expected to experience continued growth but will first see a drop in 2023 as consumer confidence weakens from economic uncertainty.

Single Family Demand Will Lead

Single family demand is projected to recover in 2024 and see continued growth through 2025, while multifamily demand is expected to see slower growth through 2025. The single family market will continue to contribute the bulk of demand through 2025, with projections to grow from 46.9 million units in 2022 to 47.4 million units in 2025. Single family permits are already showing signs of improvement, as of mid-2023, as builder confidence turns positive for the first time in almost a year.

Learn more about DemandBuilder® Residential Windows today. For a full demo of our interactive portal or to inquire about the cost to purchase data please email sales@principiaconsulting.com.