What is the Size of the Fencing Market?

Featuring in-depth data and insights backed by primary research – now available in PDF, Excel and our interactive portal.

Residential fencing volume growth in 2022 was modest, while value grew at a higher rate due to price increases. Residential fencing demand increased from a value of $6 billion in 2021 at 410.3 million linear feet to $7.1 billion at 419.3 million linear feet in 2022.

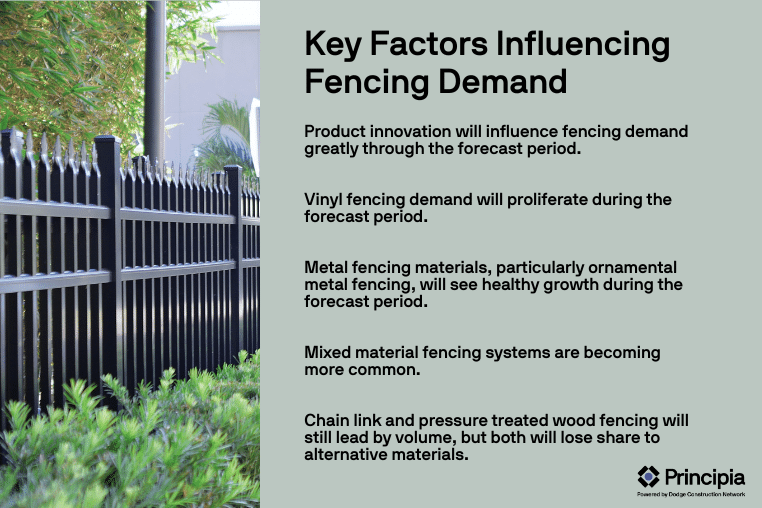

Factors influencing residential fencing demand include:

Product innovation will influence fencing demand greatly through the forecast period. In a recent Principia survey, 59% of homeowners said performance is very important when it comes to choosing fencing products. Material type and aesthetics were the next top choices when considering a fence product, which validates products that are built to last and have low maintenance will continue to drive homeowner fence selection.

Vinyl fencing demand will proliferate during the forecast period. As stated previously, homeowners wanting reliable materials with lasting durability and low maintenance will drive up vinyl’s share of fencing volume. With premium wood products still seeing labor issues and higher prices than previous years, the switch to and recognition of vinyl fencing will continue to grow. Improved vinyl materials with more color and finishing options are also hitting the market and should boost conversion away from wood.

Metal fencing materials, particularly ornamental metal fencing, will see healthy growth during the forecast period. According to Principia research, most homeowners chose aluminum fencing for their property, more than any other material. Many homeowners are choosing metal ornamental fencing with aluminum as their material of choice due to its aesthetic and strength in coastal areas, especially in the Southeast.

Chain link and pressure treated wood fencing will still lead by volume, but both will lose share to alternative materials. While both chain link and pressure treated wood fencing lead in market volume, they are the incumbent products in an advancing market that is looking for newer, more aesthetically pleasing fencing products. With the switch to vinyl and metal ornamental fencing becoming more prevalent, both chain link and pressure treated fencing will see their shares decrease over the next three years.

Mixed material fencing systems are becoming more common. As seen in the railing market, mixed material fencing has been and will become increasingly common in new residential fence projects. Mixing wood, vinyl, or composite fencing with metal infill is expected to rise especially within the privacy/semi-privacy application, as fencing aesthetics are becoming more important. Homeowners are starting to pay more attention to fence materials than in the past, and suppliers are taking notice with more intricate fence designs.

Single Family Construction Will Drive Fencing Demand

The majority of fencing demand comes from single family dwellings, accounting for more than three-fourths of volume in 2022, with multifamily low-rise (three stories and lower) accounting for the next largest share of market volume. These two dwelling types will drive growth through 2023, offsetting a decline in multifamily high-rise demand.

Southeast Expected to Experience Strongest Growth

The Southeast accounted for more than a fourth of residential fencing volume in 2022 and is forecast to grow the strongest through 2025. This region has been and continues to be fencing’s strongest market, with fencing being a top priority for people moving to the area mainly driven by the desire for privacy in an increasingly dense area.

Learn more about DemandBuilder® Residential Fencing today. For a full demo of our interactive portal or to inquire about the cost to purchase data please email sales@principiaconsulting.com.