Are Contractors Breaking Up with Their Favorite Brands?

Brand loyalty has been a longstanding cornerstone of the building materials industry, with contractors often sticking to the brands they trust. However, recent survey data suggests a significant shift in the dynamic of brand loyalty.

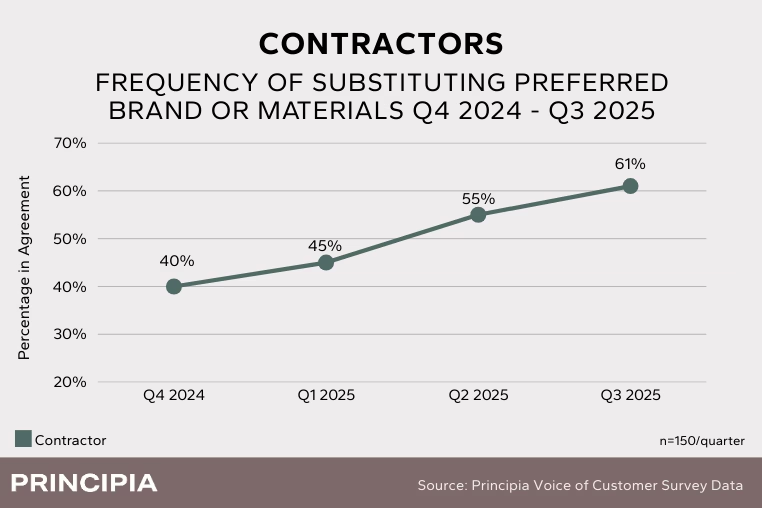

Over the past year, Principia has tracked the sentiment of contractors regarding their purchasing habits. Respondents were asked whether they agree or disagree with the following statement: “We substitute our preferred brands or materials for alternatives more often than we did 12 months ago.”

The results reveal a clear and accelerating trend.

A Growing Trend of Brand Substitution

A rising number of contractors substitute their preferred brands for alternatives, a trend that has steadily increased over the past year. In Q4 2024, 40% of contractors surveyed agreed they were substituting brands or materials more often. This figure alone suggests a notable change in behavior. However, by Q3 2025, contractor agreement jumped to 61%. This 21-percentage-point increase in less than a year indicates the factors driving brand substitution are becoming more pronounced.

This shift isn’t just a statistic; it reflects the real-world decisions contractors are making on job sites every day.

Why are Contractors Making the Switch?

While our survey focused on the frequency of substitution, industry-wide challenges offer clues into why contractors are looking for alternatives. Two potential factors influencing these decisions may be:

- Price Increases: The cost of building materials has been a significant concern for the industry. When a preferred brand raises its prices, contractors are often forced to find more cost-effective options to keep projects within budget and protect their margins. For many, absorbing these extra costs is not feasible, making a switch to a more affordable brand a necessary business decision. Price increases were indicated as a concern in our recent Residential Construction Sentiment Tracker.

- Lead Times and Availability: Supply chain disruptions have continued to cause delays and product shortages. If a contractor’s go-to material isn’t available when needed, waiting is often not an option. Project timelines are tight, and delays can have a cascading effect, impacting labor schedules and client satisfaction. In these situations, finding a readily available alternative from a different brand becomes the only viable path forward. This recent blog also explores homebuilder and contractor sentiment with regards to lead times.

These pressures may force contractors to weigh their long-standing brand loyalty against the immediate needs of their projects and business health.

Navigating a New Landscape

The increasing willingness of contractors to substitute brands presents both a challenge and an opportunity for building material manufacturers. For established brands, this trend is a wake-up call. It’s no longer enough to rely on a historical reputation; companies must actively address the pain points of contractors, such as price sensitivity and product availability, to maintain loyalty.

As the market continues to evolve, Principia will keep a close pulse on this sentiment.