What Is Driving Residential Flooring Demand?

June 16th. 2022

As demand for single family construction cooled in 2022, so did the residential flooring market. Robust repair and remodeling (R&R) activity was able to fend off part of the overall decline. Overall year-over-year flooring demand grew only 1% by volume, from 15.9 billion square feet in 2021 to 16 billion square feet in 2022. Market headwinds are expected to impact the category again in 2023 before things turn around in 2024.

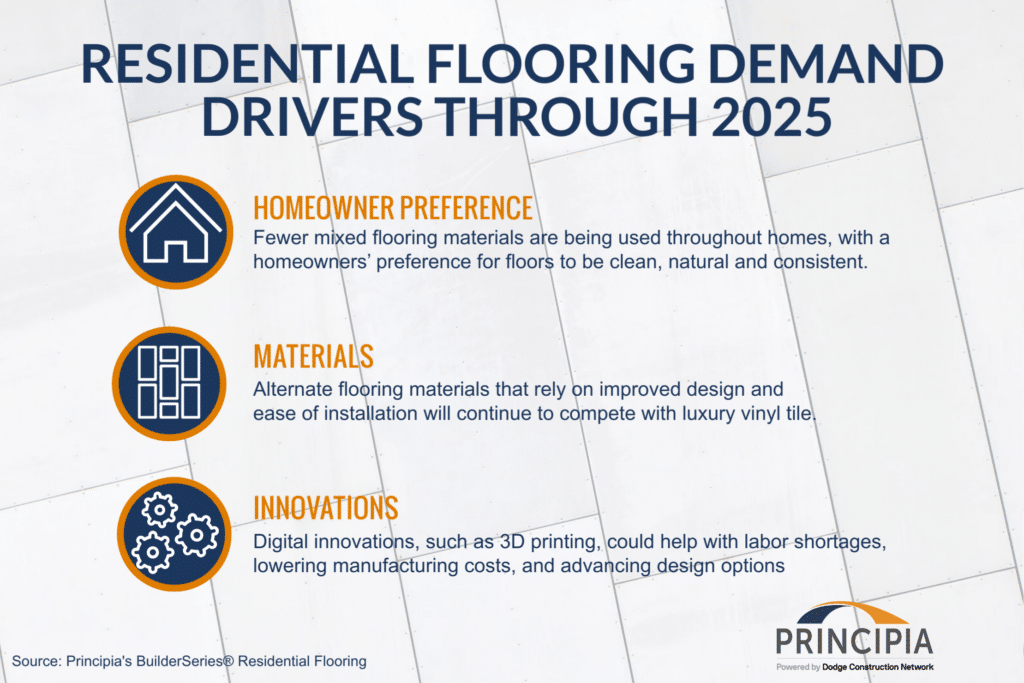

Key factors that will support flooring market demand through 2025 include:

Alternate flooring materials that rely on improved design and ease of installation will continue to compete with the flooring giant, luxury vinyl tile (LVT)

A trend toward fewer mixed flooring options through homes, with a homeowners’ preference for floors to be clean, natural and consistent

The proliferation of domestic manufacturing, which should help circumvent supply-chain issues, such as extended lead times and labor shortages

Growth in digital innovations, such as 3D printing, could help with labor shortages, while advancing design options and lowering manufacturing costs

Volume leader carpet saw a single-digit dip in 2022, LVT saw big gains

Carpet represents about two-fifths of the flooring market, although it experienced a 1.5% decline in 2022. Conversely, rigid and flexible LVT saw 8.2% and 10.2% increases respectively, which helped offset volume losses among other resilient materials (e.g., vinyl sheet, VCT). Most flooring activity occurred in single-family homes.

Residential flooring demand expected to reach 16.4 billion square feet in 2025

Rate hikes and inflation will impact flooring volume growth through 2025 (up only 0.8%). Over that time, new construction of single-family homes is expected to rebound and exceed R&R growth (up 3.7% vs. 0.1%).

Download the table of contents and list of figures for the written portion of our flooring demand product line up. For a full demo of our interactive portal or to inquire about the cost to purchase data please email sales@principiaconsulting.com