Net Manufacturer Revenue vs. Revenue Per Location

United States dealers sold $9 billion of residential door products in 2019. This included $6.8 billion in net manufacturer revenue yielding a total channel margin of $2.2 billion. The number of dealer locations selling residential doors totaled roughly 19,000 throughout the U.S.

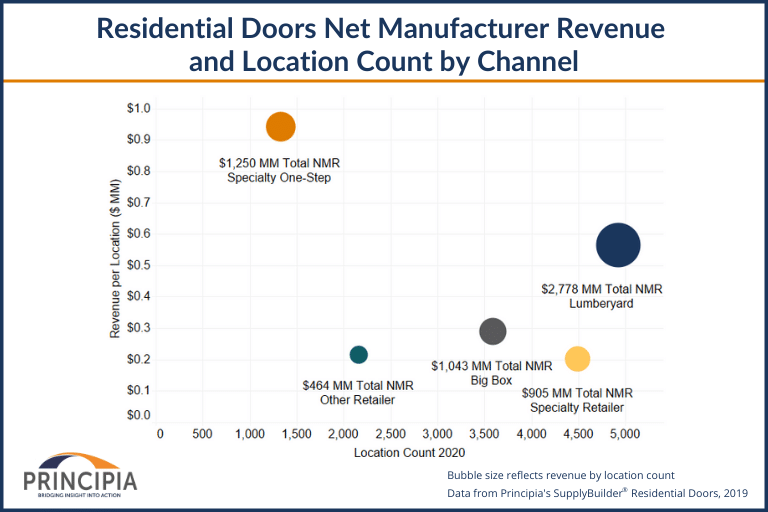

The leading dealer types selling residential doors through two-step are lumberyards and specialty one-step. Together, these two types of dealers account for two-thirds of residential door product sales. Figure 1 provides net manufacturer revenue and location count by channel. Lumberyards generate the most overall revenue; specialty one-step however has the highest average revenue per location compared to all other distribution channels.

Figure 1: Doors Net Manufacturer Revenue & Location Count by Channel

Lumberyards and Specialty One-Step Comparison

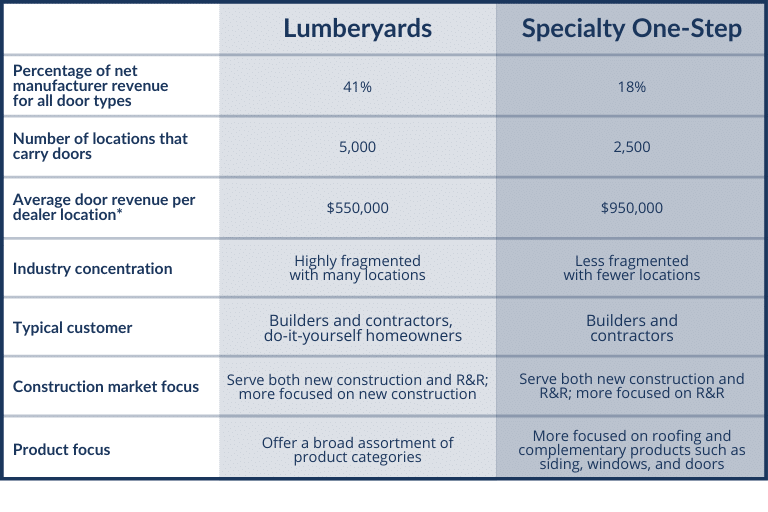

What makes lumberyards and specialty one-step successful in residential doors distribution is the added value they provide to the transaction through specialized product knowledge, jobsite delivery, and special orders. Figure 2 provides a comparison of lumberyards to specialty one-step for the residential doors channel. Lumberyards represent 41% of total revenue for all door types while the average door revenue per location is $550,000; compared to specialty one-step with 18% of total revenue and an average of $950,000 per location.

Figure 2: Lumberyards and Specialty One-Step Comparison for Doors

What does this mean for manufacturers?

An analysis of both product revenue by channel and the number of locations provides insights helpful in refining channel strategies. For instance, if expanding a dealer network with limited resources, the higher average revenue from specialty-one step could deliver a faster revenue ramp-up while servicing a more limited customer base. Conversely, targeting the lumberyard channel could require servicing a larger number of locations with a likely lower revenue per customer, but potentially provide a wider geographic audience, particularly among builders.

Principia can help industry participants use this information to support their business initiatives. More information about residential doors supply and distribution is available for purchase in four product offerings designed to meet your specific needs: Product Supply Snapshot, LBM Dealer Locator, SupplyBuilder®, and BuilderSeries®.

For more information about Principia’s supply and distribution products for residential doors, contact us today.