Net Manufacturer Revenue vs. Revenue Per Location

United States dealers sold $20.9 billion of residential window products in 2019. This included $15.4 billion in net manufacturer revenue and yielded a total channel margin of $5.5 billion. The number of dealer locations selling residential windows totaled just under 15,000 throughout the U.S.

Lumberyards are the leading channel for windows distribution overall, accounting for 31% of product sold, almost all of which is sold directly from the manufacturer to the dealer. Specialty one-step and specialty retail are also key channels. Two-step involvement in windows distribution is minimal.

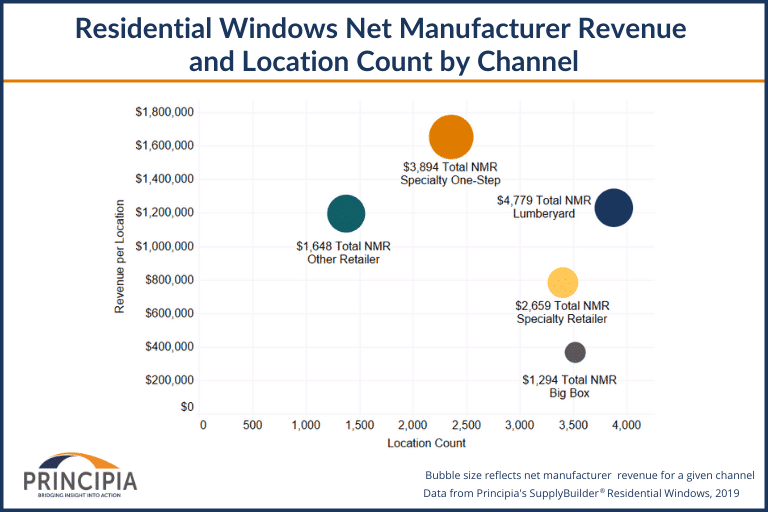

Figure 1 provides net manufacturer revenue by channel along with location counts by channel from Principia’s dealer locator database. The bubble size reflects net manufacturer revenue for a given channel. For example, specialty one-step dealers sell almost $4 billion of window products from about 2,400 locations, yielding an average revenue per location of $1.6 million.

Figure 1: Net Manufacturer Revenue & Location Count by Channel

Lumberyard and Specialty One-Step Comparison

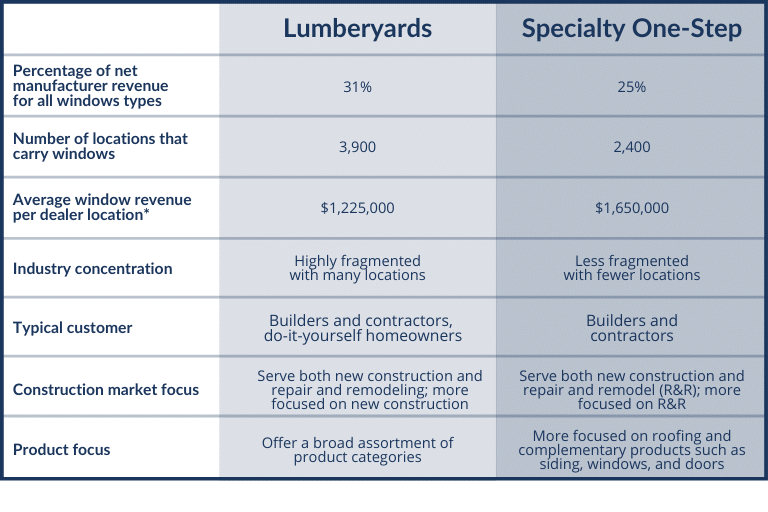

Figure 2 provides a comparison of lumberyards to specialty one-step for residential windows distribution. Lumberyards represent 31% of total revenue for all windows with an average revenue per location of $1,225,000* compared to specialty one-step with 25% of total revenue and an average of $1,650,000 per location.

Figure 2: Lumberyard and Specialty One-Step Comparison for Windows

What does this mean for manufacturers?

An analysis of both product revenue by channel and the number of locations provide insights helpful in refining channel strategies. Lumberyards—with a higher location count in windows distribution and a high average revenue per location—would be a good option for expanding a dealer network, particularly if the focus is new construction windows since builders appreciate obtaining the whole house package from the same source. Conversely, specialty one-step dealers—with fewer locations selling windows and a higher revenue per location—would be a good option if the focus is geared more toward replacement windows since these dealers have a strong focus on repair and remodel contractors and have been expanding their offerings to include complementary products such as windows, doors, and siding.

Principia can help industry participants use this information to support their business initiatives. More information about residential windows supply and distribution is available for purchase in four product offerings designed to meet your specific needs: Product Supply Snapshot, LBM Dealer Locator, SupplyBuilder®, and BuilderSeries®.

For more information about Principia’s supply and distribution products for residential windows, contact us today.