Net Manufacturer Revenue vs. Revenue Per Location

United States dealers sold $4.3 billion of residential decking products in 2019, which included $3.3 billion in net manufacturer revenue and yielded a channel margin of $1 billion. The number of U.S. dealer locations selling branded residential decking totaled over 16,000 in 2019.

Channel utilization for decking varies by product. The primary channel for wood alternative decking (capped composites, cellular PVC, uncapped composites) is two-step distribution. In 2019, 85% of wood alternative decking by value was shipped through two-step. Two-step relationships are protected by major decking suppliers to ensure unfettered market access to the pro channel and to support special order fulfillment at retail.

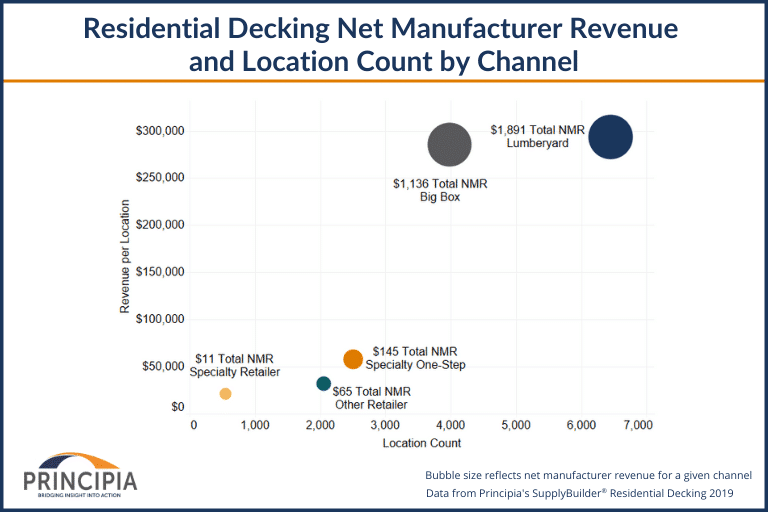

Lumberyard and big box were top sales channels for residential decking sales, accounting for 92% of wood alternative decking and 94% of wood decking by value. Figure 1 provides net manufacturer revenue and location count by channel. Lumberyards generate the most overall revenue and nearly the same average revenue per location when compared to big box.

Figure 1: Net Manufacturer Revenue and Location Count by Channel

Lumberyard and Big Box Comparison

Lumberyards add value to decking sales through deep and specialized product knowledge, jobsite delivery, and special orders. Lumberyards typically feature indoor displays showcasing supplier offerings, including sub-brand color palettes, pricing, and accessories. Dealers may also build indoor or outdoor deck replicas, giving buyers the ability to feel the products underfoot and grasp railing systems. Salespersons at lumberyards are more likely to have the time and experience to support buyers with questions on products or construction techniques.

Big box adds value in terms of convenience and accessibility, particularly for DIY homeowners. Literature takes the place of displays and replicas. In addition, a vastly improved online experience through big box websites provide an enhanced product suggestion feature, inventory levels, product information, and guides (use and care, warranty, installation instructions, and supplier catalogs).

Like lumberyards, big box takes special orders and a variety of delivery options (curbside pickup, pickup in store, or deliver to home), but is typically unable to provide the same level of customer attention face-to-face or by phone as lumberyards.

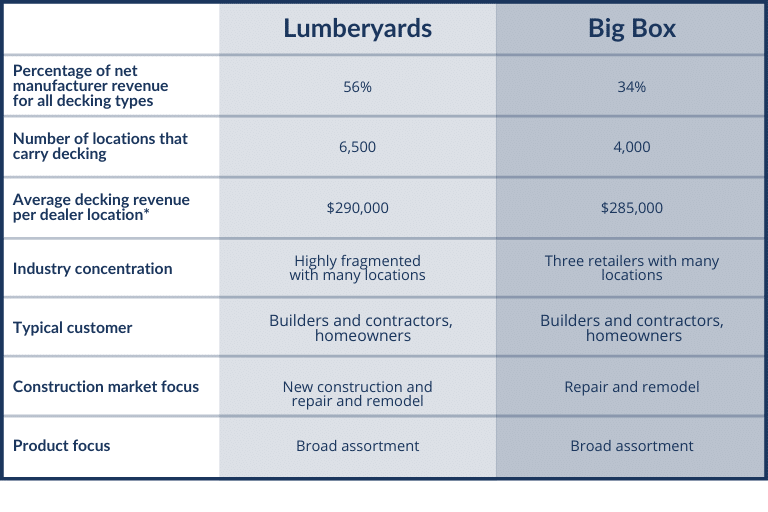

Figure 2 provides a comparison of lumberyard to big box for the residential decking channel. Lumberyards represent 56% of total decking revenue while average branded decking revenue per location is $290,0001. Big box represents 34% of total revenue and an average of $285,000 branded decking revenue per location.

Figure 2: Lumberyard and Big Box Comparison for Decking

What does this mean for manufacturers?

An analysis of both product revenue by channel and the number of locations provide insights helpful in refining channel strategies. There are 60% more lumberyard locations than big box locations and making lumberyards trickier to serve due to the sheer number of companies and need for displays. However, a supplier launching a new deck offering may want to start with lumberyards because the expertise, merchandising and hands-on approach of lumberyards may deliver better early traction in the marketplace. Two-thirds of wood alternative decking and 60% of wood decking by value moves through lumberyards. However, if a supplier is trying to expand points of sale for an existing product with limited resources, a big box strategy may be preferable.

Principia can help industry participants use this information to support their business initiatives. More information about residential decking supply and distribution is available for purchase in four product offerings designed to meet your specific needs: Product Supply Snapshot, LBM Dealer Locator, SupplyBuilder®, and BuilderSeries®.

For more information about Principia’s supply and distribution products for residential decking, contact us today.

1Counts are limited to locations carrying branded product.