Net Manufacturer Revenue vs. Revenue Per Location

United States dealers sold $16.7 billion of all residential roofing products in 2019. Asphalt represented 75% of total roofing at the net manufacturer revenue level. United States dealers sold $12.5 billion in asphalt shingles in 2019, which included $10.4 billion in net manufacturer revenue and yielded a channel margin of $2.1 billion. The number of U.S. dealer locations selling asphalt roofing totaled over 11,800 in 2020.

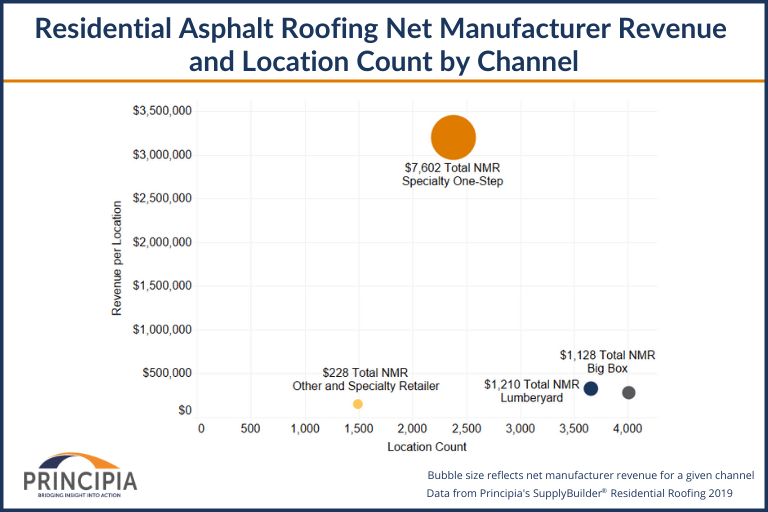

Eighty-nine percent of residential asphalt roofing was shipped direct to dealer. Specialty one-step was the primary outflow for asphalt roofing, accounting for 73% by value, followed by lumberyards at 12%, and big box at 11%. Nine percent of asphalt roofing went through two-step distribution, with the outflow going to smaller specialty one-step and lumberyards. Figure 1 provides net manufacturer revenue and location count by channel. Specialty one-step generates the most overall revenue as well as the highest average revenue per location compared to all other distribution channels.

Figure 1: Net Manufacturer Revenue & Location Count by Channel

Specialty One-Step and Lumberyard Comparison

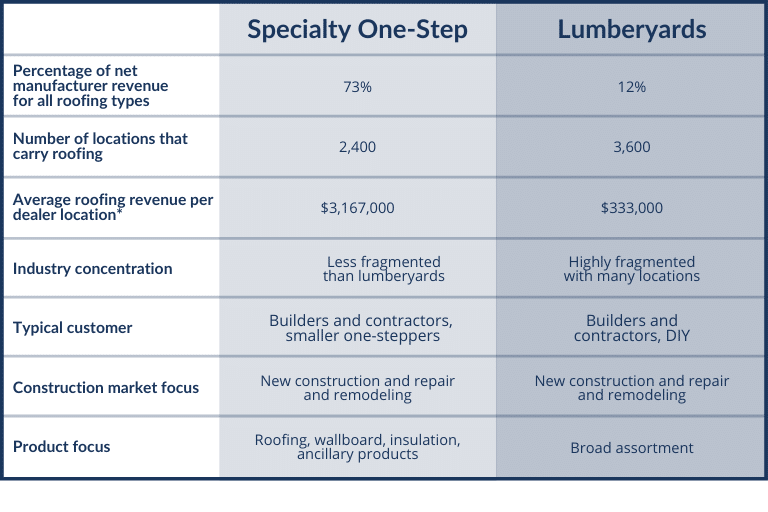

Specialty one-step is the primary channel for asphalt roofing sales, surpassing all other channels. Specialty one-steppers’ deep inventory, rooftop delivery equipment, and estimating and weather tracking tools all add value and keep contractor relationships sticky.

Lumberyards provide specialized product knowledge with hands-on support and serve as a secondary channel for asphalt roofing by providing ready access to product for smaller contractors and DIY.

Figure 2 provides a comparison of specialty one-step to lumberyards for residential asphalt roofing. Specialty one-step represents 73% of asphalt roofing revenue and the average roofing revenue per location is $3.2 million. Lumberyards represent 12% of asphalt revenue and an average of $333,000 per location.

Figure 2: Specialty One-Step and Lumberyard Comparison for Roofing

What does this mean for manufacturers?

An analysis of both product revenue by channel and the number of locations provides insights helpful in refining channel strategies. Asphalt roofing suppliers clearly gravitate to specialty one-step: a channel built to serve roofing, and which delivers high average revenue per location. The fact that the three largest one-steppers control approximately half of residential roofing gives them enormous buying power as well as the ability to control pricing to builders and contractors. A supplier with limited resources will turn to specialty one-step because the channel delivers faster revenue ramp-up while servicing a more limited customer base. The lumberyard channel requires servicing a large number of locations with low revenue per customer, but may more flexibly reach builders and contractors in markets unserved by the top three roofing specialty one-steppers.

Principia can help industry participants use this information to support their business initiatives. More information about residential roofing supply and distribution is available for purchase in four product offerings designed to meet your specific needs: Product Supply Snapshot, LBM Dealer Locator, SupplyBuilder®, and BuilderSeries®.

For more information about Principia’s supply and distribution products for residential roofing, contact us today.